Organisation of the FWB

Organisation of the FWB Mixed structure of public and private law

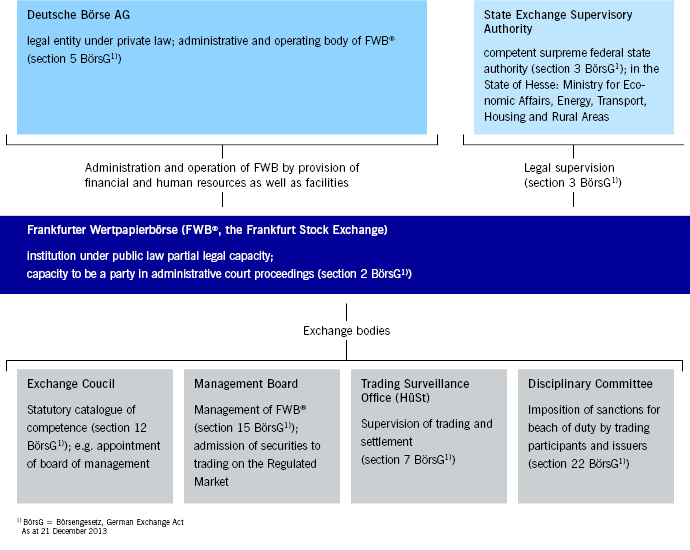

In Germany, a stock exchange, as a public law institution with limited legal capacity, cannot act as a legal entity under private law. An organiser is required for the execution and appropriate development of stock exchange operations. The organiser provides the necessary personnel and financial means as well as the premises.

The organising company of the Frankfurter Wertpapierbörse (FWB®, Frankfurt Stock Exchange) is Deutsche Börse AG. Deutsche Börse AG’s organisational and operational duties encompass trading in the following securities: shares, bonds, funds, Exchange Traded Funds (ETFs), Exchange Traded Products (ETPs) and structured products such as certificates and warrants.

The FWB is represented and run by various bodies and committees:

- The Management Board manages the stock exchange business and performs the public administration duties assigned to the stock exchange.

- The Exchange Council monitors the Management Board and decides on regulations for the trading of securities on the FWB. A further task is appointing and dismissing managing directors.

- Market surveillance monitors trading and adherence to rules.

- The Sanctions Committee penalises violations of the rules and regulations of the FWB.

As the paramount state authority in Hessen, the Ministry for Economic Affairs, Energy, Transport, Housing and Rural Areas is responsible for the legal supervision of the FWB.

Today, the FWB is one of the world’s largest stock exchange for securities trading. With 90 per cent of its turnover generated in Germany, namely at the two trading venues Xetra® and Börse Frankfurt, it is the largest of the seven regional securities exchanges in the country.