Road to IPO

Road to IPO There is no typical IPO candidate

One of the main reasons for a company to go public is to raise growth financing. The total capital raised initially from an IPO is significantly higher than the amount made possible through financing rounds with venture capitalists in Europe. Going public makes it possible to access capital not previously available before an IPO. This comes from several sources, such as institutional investors, equity capital from investors, family offices, asset managers and retail investors. Investors that are directly associated with Deutsche Börse represent 35% of the world’s institutional capital. For example, Delivery Hero’s IPO raised € 989 million for the company, independent of financing through banks. This expands the entrepreneurial scope for growth, internationalisation, innovation, research, and development as well as acquisitions.

Plus: Listed companies have the option to conduct recurring capital increases. This helps raise the capital that companies need as they grow and which the dynamic markets of the digital industry require. Therefore, an IPO offers long-term access to capital, insuring competitiveness.

More reasons for a start-up to go public

An IPO

- Strengthens equity base and improves credit worthiness – this in turn facilitates the procurement of debt capital.

- Offers current investors, like business angels and VCs, an attractive exit option – they can sell their shares during the IPO.

- Increases the awareness of a company and its products. Going public is a high publicity event that goes hand in hand with broad media coverage, which gives a company a lot of visibility on both the German and European markets.

- Increases trust among customers, business partners and banks. The company valuation on the capital market takes place in real time and the company will be included on leading German, European, and global benchmark indices followed by investors, such as STOXX and DAX.

- Increases attractiveness as an employer, not only through its heightened reputation, but also because employees themselves can invest in the company.

- Offers interesting opportunities to meet other businesses through Deutsche Börse’s network of contacts.

Reasons to go public at a glance

What are my options? Listing possibilities beyond an IPO

The traditional IPO is the listing of a company's shares on an organized capital market. Shares from the portfolios of existing shareholders will be offered in connection with a capital increase. This is also referred to as an initial placement. While the IPO is the most famous way to raise financing on the capital market, there are additional listing trends:

Direct listing: In a Direct Listing process, existing shares (founder, employee and investor shares) will be listed without raising capital. You can find more information on this in our podcast.

SPAC: A SPAC or acquisition purpose company with no own business operations. Its sole objective is to raise capital through a listing, the proceeds of which are subsequently used to acquire a non-listed company within a limited period of time and to indirectly list it on the stock exchange.

IPO-Bonds: IPO candidates may use convertible bonds or bonds with stock options, combined with a direct listing of the created shares on the IPO exercise date.

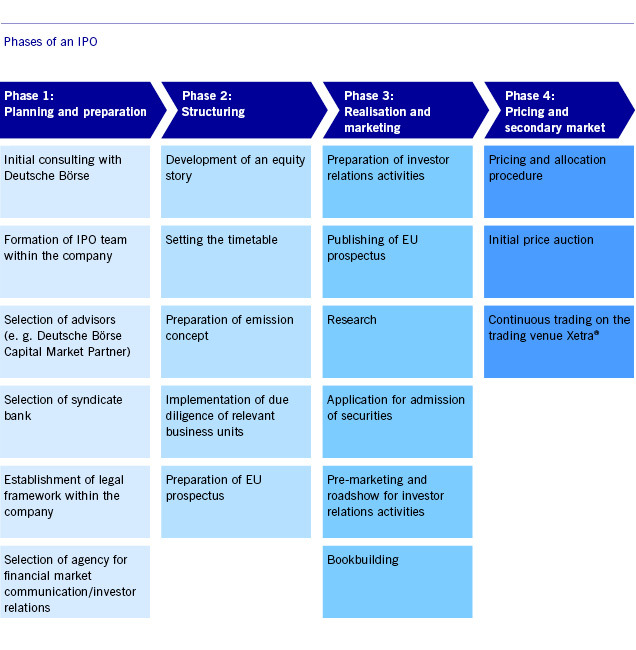

Step by step to an IPO: going public within one year

The four phases of an IPO

From the very first contact, Deutsche Börse supports companies on their way to an IPO. The most important steps are the following: