ESEF: digitalised finances for investors - Mandatory for accounting and an optional extra for investor relations

ESEF: digitalised finances for investors - Mandatory for accounting and an optional extra for investor relations By Dr Martin Steinbach and Gerd Winterling, EY

All companies that have issued securities on regulated markets within the EU are required to prepare and publish their annual financial reports for all financial years beginning on or after 1 January 2020 in a single European-wide electronic reporting format (European Single Electronic Format - ESEF). The origin of the ESEF lies in the Transparency Directive (2004/109/EC of the European Parliament and of the Council of 15 December 2004), which requires issuers whose securities are admitted to trading on regulated markets within the EU to publish their annual financial reports. Since the Transparency Directive Amending Directive (2013/50/EU), Art. 4 (7) provides that annual financial reports are to be prepared in a single electronic reporting format with effect from 1 January 2020.

The objective: increased comparability and more transparency

The European Securities and Markets Authority (ESMA) proposes making annual financial reports available as electronic documents in XHTML (eXtensible HyperText Markup Language). IFRS consolidated financial statements must also be converted into a predefined content structure using the iXBRL (inline eXtensible Business Reporting Language) standard.

This regulation is generally expected to provide increased transparency and comparability for capital market participants, such as investors, regulators, analysts and other target readers of financial statements. For one thing, the uniform structuring of the report content is intended to ensure improved comparability. And for another, the specialised electronic preparation will enable better processing of data in future, and even automated preparation and analysis. It will also be easier to convert data sets into formats such as Excel. All these changes are ultimately intended to make annual financial reports and IFRS consolidated financial statements much more transparent.

First-time adoption for 2020 IFRS consolidated financial statements of issuers in regulated markets

First-time adoption for consolidated financial statements prepared in accordance with the IFRSs for financial years beginning on or after 1 January 2020 requires a new format of presentation for monetary disclosures of the primary components of the financial statements, the consolidated statement of financial position, the consolidated statement of comprehensive income, the consolidated statement of changes in equity and the consolidated statement of cash flows as well as selected textual disclosures (e.g. name, registered office and legal form of the company). With effect from financial years beginning on or after 1 January 2020, textual information in the notes to the consolidated financial statements (“IFRS Notes Disclosures”) as listed by ESMA (see Annex II no. 3 in conjunction with table 2 of the provisional delegated regulation) must also be made available.

The requirements for the introduction of ESEF result from well over 800 pages and the published taxonomies. A taxonomy is a system of accounts classification with much additional information. The ESEF taxonomy is based on the IFRS Taxonomy of the IFRS Foundation.

Tagging and mapping in the implementation phase

Implementation of the ESEF for IFRS consolidated financial statements is fraught with a large number of stumbling blocks. Companies are well advised to implement processes to ensure that the taxonomy used and the technical standards are always up to date. The accounting system should be designed in such a way that new features at all levels can be entered into the system at any time, as application of the prescribed content structure of the ESEF taxonomy is mandatory, and it must be repeatedly supplemented as necessary. Financial information is tagged electronically to make it both automatically human- and machine-readable data with suitable software, for the target audience. Tags are stored in the XBRL taxonomy. When selecting the tags, the basic element with the narrowest definition of the subject matter is to be selected.

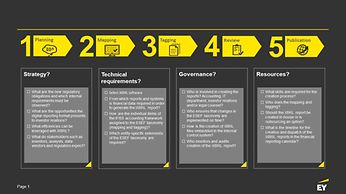

Five steps to the iXBRL report

The core of the implementation is the mapping in accordance with the prescribed taxonomy. Mapping means that each item of a financial report is assigned to an element of the ESEF XBRL taxonomy. A problem arises when individual items are either not defined at all by the regulator or are defined differently than in the existing financial report. Core elements of the ESEF taxonomy may thus not be changed, although entity-specific names for existing core elements can be added. If a suitable taxonomy element is missing, it can be supplemented (extension).

Extent of and open questions on implementation

The extent of implementation will ultimately depend on many factors: the size of the company, the number of items, the scope of the notes, the current process, existing IT systems and expertise, and ultimately also the defined target image. The redefinition of the target image can be used to improve the financial statement closing process or to restructure the familiar IFRS notes to create a possibly more meaningful presentation.

Questions also arise with regard to the audit of the financial report to be published in accordance with the new single electronic reporting format. This is because the effects on the audit or the auditor – such as how the auditor is included, exactly what the audit object will be in the future, how large the scope of the audit is and how the audit opinion on the financial reports prepared in ESEF format should be structured – have not yet been substantiated by means of a professional association pronouncement.

From mandatory to optional extra: bridging the gap between accounting and investor relations

Digitalisation is finding its way further into modern capital market communication with the machine-readable iXBRL format. The obligation to use the new format opens up a great deal of potential in investor relations practice. In investor relations in addition to human-to-human communication, another channel of communication is becoming established the machine-to-machine communication. Financial data from the financial statements can thus be accurately read by sophisticated algorithms. Smart analysis software enables investors to perform highly automated peer group comparisons and key figure analyses in real time. Tagging and mapping facilitate automated research and have the potential to democratise research for small and medium-sized issuers in accordance with MiFID II. In the secondary market too, the increased availability of information and research is attracting greater attention from investors and offering the opportunity for more liquidity. This is how mandatory implementation of ESEF becomes an optional investor extra.

EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information about our organization, please visit www.ey.com.

[Source] ESMA website: https://www.esma.europa.eu/document/esma-esef-taxonomy-2017