Employee and manager involvement before and during an IPO

Employee and manager involvement before and during an IPO By Prof. Dr Wolfgang Blättchen and Uwe Nespethal

Share participation schemes are a must for young tech firms

The question of whether to set up a staff and management participation scheme generally comes up at a very early stage for technology companies, as they face stiff and often global competition for the “brightest minds”. On the one hand, they can't offer salaries on the same scale as the large established companies, but on the other, management and skilled staff with several years' experience in the tech industry in the USA expect such remuneration components. Moreover, venture capital investors are also increasingly demanding such incentive schemes to promote long-term loyalty among key employees and motivate them to provide excellent performance to increase future value.

Most early-stage companies do not yet operate in an exchange-listed legal form (stock corporation under German law (AG), public company under EU law (SE) or partnership limited by shares under German law (KGaA)), so the traditional share-based employee participation instruments such as stock options are generally ruled out. At this stage, share purchases by employees in the form of compensation for work performed are also rare, because of tax law obstacles (risk of “dry income”), and are generally not wanted by existing shareholders, particularly institutional VC investors, either. The investors fear that it would complicate the decision-making processes under company law.

SAR plans popular in early stage

In practice, “phantom stock” plans, also known as “stock appreciation rights” (hereinafter SAR), are more often used. SAR plans are purely contractual promises of the company and sometimes also the shareholders to the beneficiaries in the event of a future exit (sale of the company or IPO), to pay out in cash the increase in value between a defined base value when the SARs are issued and the future exit value. The beneficiary does not have to pay anything in order to be granted SARs, and the process is usually tax-free for the beneficiary. On the other hand, these rights are not transferable to third parties. However, the issue of SARs is a remuneration component for the company, which must be recognised with a provision on the balance sheet in accordance with both the German Commercial Code (Handelsgesetzbuch - HGB) and IFRS. The expense is divided pro rata over the expected vesting period. In contrast to the accounting for stock options, subsequent changes in fair value are to be recognised as an expense on each reporting date. In the event of an exit, the beneficiary[1] is subject to personal income tax and social security contributions for the “non-monetary benefit” paid out. In economic terms, SARs function like traditional stock options, the difference being that issuing them is not subject to the complex provisions of the Stock Corporation Act (Aktiengesetz – AktG). Because the SAR plan always involves an outflow of funds when exercised, the instrument should only be exercisable in connection with a “cash event” (sale, capital increase) for cash flow-negative companies. Stock options, on the other hand, protect the issuer's liquidity when exercised, as the increase in value is paid out by issuing new shares.

It is easy to issue SARs during an early stage of the company's development but can become problematic in the event of an IPO at a later date. SAR plans are generally structured in such a way that they can be completely dissolved in the event of an exit, i.e. the beneficiaries receive a one-time payout. In the case of an IPO, this mechanism can scare investors away, however, if the key persons to be motivated to generate further value growth following the IPO suddenly receive a bag full of money from the SAR plan upon the initial listing. Moreover, the SAR payout may necessitate diverting a significant amount of funds from the IPO issue proceeds. This of course involves readjustments. Stock options may be suitable for this, as described in the following.

Stock options – a traditional instrument for IPO candidates

Most companies transform into a stock corporation (Aktiengesellschaft) in preparation for an IPO. The German Stock Corporation Act (Aktiengesetz - AktG) sets out special rules for launching share-based employee participation schemes. The traditional method is to issue stock options, for which “conditional capital” of 10% of the company's existing share capital can be used. The convertible bond is another instrument that can be used, although it has lost its practical relevance for employee participation schemes since the stock option was introduced in 1999. If stock options or convertible bonds are to be issued, the Stock Corporation Act provides that the shareholders' meeting must be informed of and approve the details of the plan (scope, performance threshold, term, beneficiaries, acquisition price, issue price). It also prescribes a minimum vesting period of four years before the issued stock options may be exercised[2]. This shows the advantage of the SARs, as they are not subject to these legal formalities. As with SARs, stock options are awarded to beneficiaries without payment. In accordance with IFRS, the company is to create an appropriate provision on the balance sheet once only and distribute the expense over the term. Under HGB, it is a mater of dispute as to whether the awarded stock options need to be recognised in the accounts at all.

Stock option plans, or ESOPs (employee stock option or share ownership plans) are generally first launched shortly before the planned IPO and are part of a long-term incentive plan (LTI) that is of particular importance for executives[3] from a corporate governance standpoint. As described above, it is not unusual for companies to have an incentive scheme long before any IPO that may have to be adjusted to conform with capital market standards. One approach with SAR plans is to allow the awarded SARs to be exercised in full at the IPO, but to combine this with an immediate reinvestment in company shares. The shares thus acquired are then subject to a vesting period of several years in order to provide an incentive. Stock options are often awarded based on the number of vested shares, in order to compensate for the risk of the vesting period for beneficiaries. This kind of combination of vested shares and granted stock options is also known as a matching stock purchase plan, and is often found in IPOs of private equity-backed companies[4]. In such cases, the management already holds shares in the issuer, acquired when the private equity investors became involved as part of a management equity plan (MEP). It is also possible for only some SARs to be exercised at the IPO, rather than all of them. The SARs not exercised are blocked for a period of time and the beneficiaries receive stock options as compensation.

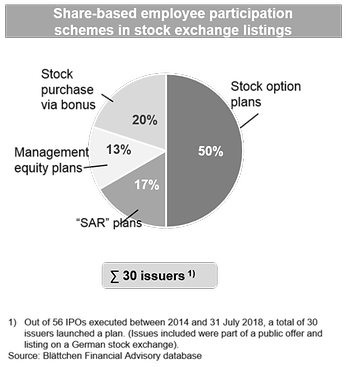

Stock option plans most popular with tech issuers

Stock option plans are generally launched by smaller issuers, with sales in the financial year prior to the IPO of around €65 million and market capitalisation at the time of the IPO of around €390 million[6]. The difference between these two figures shows that these are growth companies with a very high sales multiple. The issuers who launched SAR plans are somewhat larger (sales €156 million; market capitalisation €590 million). As expected, the highest sales figures (€400 million) and market capitalisation (€740 million) were found among private-equity-backed companies with management equity plans. The issuers with stock purchase plans have sales of around €230 million and market capitalisation of €280 million. These are established and profitable companies.

Conclusion

Share-based participation schemes for managers and employees are very important both long before, and during, an IPO. Companies can chose from a range of instruments intended to ensure long-term employee loyalty and motivation. These participation plans are a must in the early stages of existence, particularly for young growth companies. However, schemes introduced early can also have their pitfalls when it comes to suitability for the capital market. That's why a timely adjustment is necessary.

About the authors

Prof. Dr Wolfgang Blättchen is Managing Director of Blättchen Financial Advisory GmbH and has 33 years' experience as an independent advisor on capital market strategies. He is an active member of supervisory and advisory boards of listed as well as private companies.

Uwe Nespethal has been a partner at Blättchen Financial Advisory since it was founded in 2010. He has been responsible for many capital market transactions and projects relating to the stock exchange, employee participation and long-term financing strategies.

[1] Applies to employers subject to taxation in Germany

[2] See section 192 (3) in conjunction with section 193 AktG

[3] See paragraph 4.2.3 of the German Corporate Governance Code (Deutscher Corporate Governance Kodex - DCGK) as regards the remuneration structure for management board members.

[4] Stabilus S.A (2014), Tele Columbus AG (2015) and Scout24 AG (2015) introduced matching stock purchase plans at the time of their IPOs, which were combined with their existing management equity plans (MEP).

[5] The listings included took place as part of IPOs executed between 1 January 2014 and 31 July 2018 on a German stock exchange.

[6] All of the information in this section about sales and market capitalisation are median values.