Deutsche Börse, Swisscom and partners successfully settle securities transactions via tokens in Switzerland

Deutsche Börse, Swisscom and partners successfully settle securities transactions via tokens in Switzerland

Proof of concept lays the foundation for a leap in efficiency in post-trade services / Settlement of securities transactions using different DLT protocols

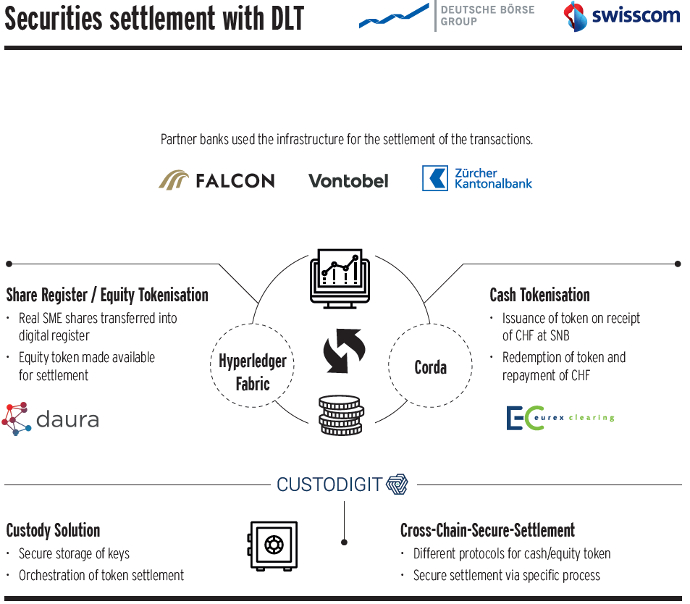

Deutsche Börse, Swisscom and the three partners Falcon Private Bank, Vontobel and Zürcher Kantonalbank have succeeded in jointly settling securities transactions with tokenised shares via Distributed Ledger Technology (DLT). With this proof of concept, the partners demonstrate how the immediate and secure settlement of legally binding securities transactions in shares of small and medium-sized enterprises (SMEs) could work in the future.

Within this proof of concept, the share registry of a real Swiss enterprise was digitalised using the platform of the start-up company daura, and the shares were then tokenised. To enable the execution of a delivery-versus-payment transaction based on DLT, money was made available in the form of cash tokens. Deutsche Börse provided the cash tokens in Swiss Francs through its subsidiary Eurex Clearing. The money was deposited as collateral in the central bank account of Eurex Clearing at the Swiss National Bank. In the following securities transactions, the banks acted as counterparties and exchanged securities tokens against cash tokens using DLT.

Deutsche Börse and Swisscom jointly designed and developed the IT architecture with the systems hosted on Swisscom’s infrastructure. Core elements were the digital share registry provided by daura and the application of Custodigit as a holistic solution for the custody and management of digital assets. The participating banks also provided important requirements for the integration of the transaction into their respective banking processes. In the preparation of the underlying legal framework, Deutsche Börse and Swisscom were supported by the law firms MME and Walder Wyss.

Two different DLT protocols (Corda and Hyperledger Fabric) were used for processing the cash and security tokens. A specific process («cross chain secure settlement») was followed for a step by step settlement to ensure that none of the parties had to make any advance payment during the settlement process. An open system approach was chosen for this project to enable a simple connection of further components or partners in the future.

“DLT has the potential to reach a new level of speed and efficiency in the financial services sector. In order to maintain Switzerland’s leading position in digital assets, cooperation and new platforms are needed. This proof of concept is an excellent example of successful collaboration and innovative strength across company boundaries”, commented Johs Höhener, Head FinTech, Swisscom.

“It is of strategic importance for us to further develop the possibilities for settlement of securities transactions using DLT. This brings us one step closer to our goal of enabling the financial services industry in Germany and in Switzerland to efficiently use the potential of this new technology”, said Jens Hachmeister, Head of New Markets, Deutsche Börse Group.

“The biggest winners of a functioning digital asset ecosystem are ultimately investors and companies, particularly small and medium-sized enterprises”, said Peter Schnürer, CEO, daura.

This successful proof of concept is a further milestone for Deutsche Börse and Swisscom in building a comprehensive ecosystem for digital assets. A productive service offering remains subject to the approval of respective regulatory and oversight authorities and compliance with the relevant regulatory requirements and applicable directives.

About Custodigit

Custodigit was founded in 2018 as a joint venture by Swisscom and Sygnum. They provide a technical solution for custody of digital assets for regulated financial services institutions. The platform allows bank customers to manage the entire lifecycle of their digital assets. As well as secure storage, the platform has a rich set of features including integration to core banking systems, key management, tax reporting, compliance services and other value-added services. Having an institutional grade custody solution ensures that clients are also able to demonstrate regulatory compliance.

Custodigit has an ambitious roadmap to grow the platform to offer a wider range of crypto asset, and help their clients scale their business.

About daura

daura uses blockchain technology to digitise shares of small, medium-sized and established companies from Switzerland. By registering on the daura platform Swiss stock companies can digitise their share register, digitally carry out capital increases quickly and affordably and update the share register in the event of changes in holdings. As a joint venture of Swisscom and Luka Müller, co-founder of the law firm MME, daura relies on a network of trustworthy ecosystem partners.

About Deutsche Börse

Deutsche Börse Group is one of the largest exchange organisations worldwide. It organises markets characterised by integrity, transparency and safety for investors who invest capital and for companies that raise capital – markets on which professional traders buy and sell equities, derivatives and other financial instruments according to clear rules and under strict supervision. Deutsche Börse Group, with its services and systems, ensures the functioning of these markets and a level playing field for all participants – worldwide.

About Falcon Private Bank

Rely on more than 50 years of experience and dedication. Falcon merges traditional private banking with innovative solutions for digital assets and blockchain banking. Private clients can trade and invest comfortably in major cryptocurrencies and benefit from our secure custody solution. Blockchain and crypto-startups benefit from Falcon’s exclusive business banking solutions. Trust in our commitment to superior services and in our financial strength. We serve clients from our headquarters in Zurich and our locations in Dubai and Luxembourg. Agile private banking.

About Swisscom

Swisscom, Switzerland’s leading ICT company is headquartered in Ittigen, Berne. About 20,000 employees generated sales of CHF 11.7 billion in 2018. Swisscom supports regulated financial institutions in digitization. One of the central fields are digital asset services.

About Vontobel Investment Banking

Vontobel Investment Banking creates specialized investment solutions for private and institutional clients. We follow a customer-centered digital business model, manage risks carefully, and build compelling service packages to get our clients ahead. Our key objective is to truly understand our clients’ needs. We use our expertise to anticipate trend reversals, risks, as well as opportunities in order to successfully exploit them for you. We only do what we master and develop solutions we believe in. We take clear decisions and act with determination. We are proud of our specialized offering which includes structured products, transaction banking, corporate finance, brokerage, as well as solutions for External Investment Advisors, and digital platforms. For our competence in Research, we regularly get awarded. This is how we create added value for you. Since 2016, we have also been offering certificates on the crypto currencies Bitcoin, Bitcoin Cash, Ether, Ripple, and Litecoin as well as custody services of digital assets. We were the first regulated bank to bring a structured product in the form of a security token to the blockchain.

About Zürcher Kantonalbank

Zürcher Kantonalbank is a leading universal bank in the Greater Zurich Area, with national roots and international reach. It is an independent public-law institution of the Canton of Zurich and has received top ratings from the rating agencies Standard & Poor's, Moody's and Fitch (AAA or Aaa). On a stand-alone basis, i.e. excluding the state guarantee, Zürcher Kantonalbank also ranks as one of the world’s most secure universal banks, with an aa- rating from Standard & Poor's. With more than 5,000 employees, Zürcher Kantonalbank offers its clients a comprehensive range of products and services. The bank's core activities include financing businesses, asset and wealth management, trading, capital market transactions, deposits, payment transactions and card business. Zürcher Kantonalbank provides customers and distribution partners with a comprehensive range of investment and retirement provision products and services.