Indices

Indices Information on the capital markets: We ensure market activity is transparent – with prices, indices, and statistics

Indices serve to structure the stock market and thus focus investor attention. For the broader general public they serve as a barometer of market activity and also provide the underlying basis for derivatives and as the benchmark against which performance can be measured, e.g. for individual stock and for funds.

Indices measure performance in the capital markets. Together with statistics and historical data, they offer an empirical insight into trends in the capital markets.

The world of Deutsche Börse indices is therefore carefully tailored to investor needs. DAX®, MDAX®, TecDAX® and SDAX® are Deutsche Börse selection indices based exclusively on companies listed in the Prime Standard segment.

In the form of GEX® Deutsche Börse took as the criterion for the index that a company be managed by the founders or owners. GEX is the indicator for the performance of publicly-listed SMEs. Family-run companies are tracked in the DAXplus Family 30, which functions as a “family index” for the 30 largest family-run companies, by market capitalisation. Again, the condition for inclusion in these two selection indices is a listing in the Prime Standard.

The RX REIT selection index tracks the performance of companies listed on the Deutsche Börse REITs segment that fulfil the transparency requirements of Prime Standard.

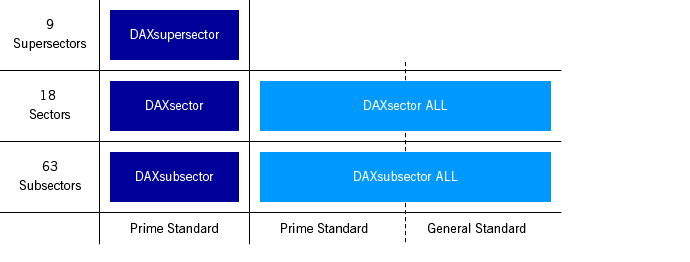

Sector indices differentiate between the listed corporations and reflect trends in individual sectors. These sector indices help a comparison of the performance of providers of similar products or services. They are subdivided into 18 sectors and are compiled in nine super-sectors. Companies are assigned to sectors on the basis of classification by 63 subsectors. All companies that are admitted to the Prime Standard or General Standard are included in a sector index and subsector index.

Moreover, Deutsche Börse computes a selection index for the General Standard: the General Standard Index.

In addition to selection and sector indices, Deutsche Börse offers All Share indices, which encompass all securities from companies in a defined sub-sector and covering different segments. These benchmark indices have a wider reach and as such are particularly tailored to the needs of investment firms which measure the performance of their portfolios against the performance of these indices. They include, e.g., the Prime All Share, General All Share, Scale All Share and CDAX®, which encompasses all German stocks in Prime Standard and General Standard.

- Index inclusion

- Equity indices rankings

Equity indices rankings

Companies included in the Prime Standard can subscribe to the stock indices ranking lists for the DAX®, MDAX®, SDAX® and TecDAX® indices n a monthly basis and use the lists in their investor relations work. Issuers included in the Prime Standard segment can make use of this service free of charge by concluding a contract for the provision of Deutsche Börse ranking lists.

To conclude a contract or obtain further details, do not hesitate to contact:

STOXX Customer Support

E-mail: customersupport@stoxx.com

Tel.: +41 58 399 5900