Market Surveillance in Germany

Market Surveillance in Germany Market Surveillance ensures proper conduct of trading

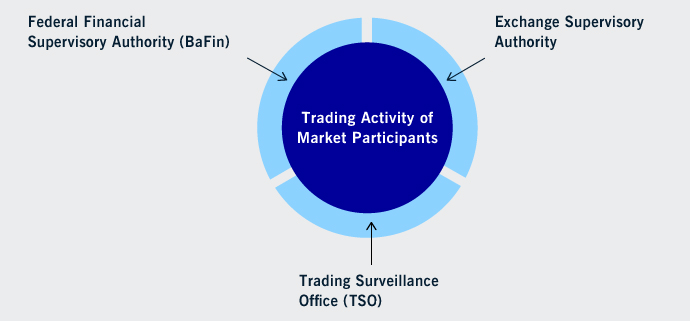

A functioning market surveillance is indispensable for the proper conduct of exchange trading including the correct determination of prices in accordance with the rules. In Germany, several authorities work closely together here.

Federal Financial Supervisory Authority (BaFin) Exchange Supervisory Authority (BAB)

Trading activities and market participants

Trading Surveillance Office (TSO)

Their aim is to ensure national and international standards are upheld.

- The TSO monitors trading

- Investigations and operations of the TSO

- Exchange Supervisory Authority

- BaFin

Exchange Supervisory Authority

The exchange supervisory authorities operate at state level. In the State of Hesse the exchange supervisory authority is incorporated into the Hessian Ministry of Economic Affairs, Energy, Transport, Housing and Rural Areas. Its tasks include ensuring that participants admitted to exchange trading adhere to Exchange Act regulations.

In cooperation with the TSO, it supervises pricing processes and assesses irregularities and infringements of regulations reported to it. In addition, it conducts the legal supervision of the exchange bodies. In addition to the Management Board, the Exchange Supervisory Authority can also forward proceedings relating to infringements of regulations by market participants to the Sanctions Committee. As part of its activities, the Exchange Supervisory Authority also approves the regulations of Frankfurter Wertpapierbörse (FWB®, the Frankfurt Stock Exchange) and Eurex Deutschland.