Listing process Open Market

Going Public Open Market

Overview

ISIN/Master Data

Briefly, you have to do the following

- Apply for an ISIN

- Provide your master data

General

The ISIN is an international securities identification number for stock and certificates representing stock as well as for bonds, options and futures. It consists of a twelve-digit combination of letters and numbers which clearly identifies each security. In cross-border securities trading, the ISIN functions, in a way, like the number inside an identity card which technically allows for both national and international tradability and settlement of securities transactions as well as securities custody.

Competent agency

The ISINs are issued by central national organisations, the so-called "Association of National Numbering Agencies". In Germany, the publishers' association WERTPAPIER-MITTEILUNGEN Keppler, Lehmann GmbH & Co. KG (WM) has assumed the role of national registry for securities identification numbers (hereinafter referred to as "WKN"). It is an information service provider for the financial sector based in Frankfurt am Main, which, as part of its function as an issuing office, also manages the securities identification numbers and data in the form of a publicly accessible securities register, which contains all data available at WM on issuers and their financial instruments.

WM Datenservice

Düsseldorfer Straße 16

60329 Frankfurt am Main

Tel: +49/69 2732 480

Application

An ISIN may be applied for by the issuer as well as by the syndicate bank. The ISIN is being issued in compliance with the ISO Standard 6166. This standard defines the structure of an ISIN on the one hand and the requirements for the allocation of the ISIN on the other. These stipulate, among other things, that certain minimum information on the issuer and the security is a prerequisite for the allocation of an ISIN. Domestic issuers must for example submit a current excerpt from the commercial register and a current statute.

An ISIN is being issued upon respective application:

- as fax message to WM-WKN-Service: (0) 69/25 00 66 or (0) 69/24 24 84 76

- as email to wkn-isin-de@wmdaten.com or wkn-isin-intl@wmdaten.com

The relevant application form for an ISIN can be found at the websites of WM Datenservice.

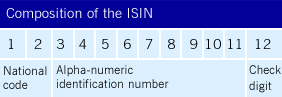

Composition of the ISIN

According to ISO Standard 6166, the ISIN consists of a total of 12 characters. The first two letters serve as country code (see ISO Standard 3166). German ISINs start with the country code "DE". This is followed by a nine-digit alphanumeric combination, which can consist of the capital letters A to Z (without umlauts) and the numbers 0 to 9. A check digit forms the conclusion. This is calculated according to a fixed algorithm.

FAQ: ISIN/Master data

Helpful Information for Issuers of Securities

History

From 1955 until the introduction of the ISIN in April 2003, six-digit numeric WKNs were assigned in Germany to identify national securities. In the mid-1980s, when more and more investors were transacting securities transactions across national borders and continents, a frequent conversion of securities identification numbers into country-specific securities identification numbers was necessary.

In 1992, 22 national WKN awarding bodies founded the (Association of National Numbering Agencies, “ANNA”) with the aim of advancing the existing, but hardly used, ISIN awarding option. In this context, an electronic platform (GIAM = Global ISIN Access Mechanism) was created just three years later with the help of which ISIN-relevant data could be exchanged. The database was used for further dissemination of the ISIN. After an extension of the data platform in 1999, data on ISIN markings could be merged worldwide and made available to other data providers.

In January 2000, the competent authorities in Germany decided to successively implement the ISIN as the new obligatory securities identification number. From the time of implementation on, already existing securities identification numbers either were continued additionally or transferred to an ISIN.

- Calculation of the ISIN check digit

The check digit of the ISIN is calculated by means of a standardized algorithm (Modulus 10 Double-Add-Double):

First all letters of the ISIN are being replaced by numbers. For this the position of the respective letter in the alphabet is increased by nine. Thus A becomes the number 10, B the number 11, ... and from Z the number 35. In contrast, all digits remain unchanged. Thus, for example, DE000ENAG99 becomes 13140001423101699 and DE000BAY001 becomes 1314000111034001.

- Starting with the last digit, every second digit is multiplied by two and replaced by the cross total. Thus 13140001423101699 turns into the digit sequence 23240001826101399 and 1314000111034001 into the digit sequence 1618000212064002.

- The digits of the resulting digit sequence are added up, i.e. their cross total is generated and the difference to the next higher number of tens is determined. This difference, if smaller than 10, will be the actual check digit or will result, should it equal 10, in a check digit 0. Therefore, for DE000ENAG99 or 13140001423101699, respectively, the cross total will be 51 and their ISIN-check digit will be 9 and for DE000BAY001 or. 1314000111034001, respectively, the cross total will be 33 and, thus, their ISIN-check digit will be 7.

- Basic information for issuers

Please find information regarding the legal basis, the components, wording and further matters concerning the topic ISIN/ master data compiled under ”Detailed information”.

Selection of a “favourite“-ISIN

As a rule, the ISIN will be issued by the numbering agency according to a certain scheme (see above). However, like selecting a special automobile number plate, it is also possible to apply for a favourite ISIN. In this case the core of the ISIN, the nine-digit basic number, will be allocated according to a sequence of numbers or letters or a combination of both individually selected by the applicant. The general rules for allocation, however, apply to this case also. WM Datenservice retains the right to deny without giving reasons the application for a favourite ISIN.

Details regarding this issue as well as the costs connected to it may be inquired directly at WM-Datenservice.

Contact: Help-desk@wm-daten.com, Tel: +49-(0) 69-27 32 480, catchword “Issuers Code”

Master data

The necessary data collected in the course of issuing an identification number which, similar to the particulars in a passport, serve the purpose of identifying the security are called master data. When applying for an ISIN, the applicant has to provide the numbering agency with all relevant master data referring to the security. Depending on the kind of security (e.g. stock or bond), these are, above all:

- ISIN/securities identification number

- issuer

- category

- stock market where the security is being traded

- state of origin

- currency.

These data will be collected by the numbering agency WM-Datenservice and provided in a publicly accessible register (WM-Wertpapier-Register (WM Securities Register). When applying for an ISIN, the applicant also has to furnish the numbering agency with a copy of a current excerpt from the commercial register accompanied by a copy of the articles of association. In the time to follow, WM Datenservice will need further information on circumstances following the issuance, like information on approaching general shareholders meetings, distribution of dividends or intended corporate actions. WM Datenservice will demand such data from the company based on the publications in the Bundesanzeiger (BANZ) (German electronic Federal Gazette); however, up-front information is considered very helpful.

Contact: Help-desk@wm-daten.com, Tel: +49-(0) 69-27 32 480

Related links

- ANNA - Association of National Numbering Agencies

- WM Gruppe [WM Group]

- WM-Datenservice

- WM-Wertpapier-Register [WM Securities Register]

- Ländercode-Liste [List of National Codes]

- Regulation (EU) 2017/1129 of the European Parliament and of the Council